Charles Schwab : Login Your Charles Schwab Account

Charles Schwab has earned its crown as the best overall brokerage firm, scoring top marks in nearly every category we evaluate. With the acquisition and seamless integration of TD Ameritrade, Schwab has entered a new era, delivering an unbeatable combination of advanced trading platforms, robust research, and investor-focused tools.

Schwab has something for every investor, and that’s no small feat. Need in-depth research? Schwab delivers. Fixed-income tools or advanced trading platforms? Check and check. Looking for education that’s not only top-notch but actually makes sense? Done. Schwab doesn’t just keep pace with the industry — it sets the standard, blending substance and value to be the best overall brokerage firm in the industry.

verified#1 Overall Broker in 2025

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

Trade brilliantly with Schwab.Visit Site

RatingsAwardsHistorical Rankings

5.0

OVERALL SCORE

| Range of Investments | |

| Mobile Trading Apps | |

| Platforms & Tools | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com’s picks for the best stock brokers in 2025.

| #1 Overall | Winner |

| #1 Platform & Tools | Winner |

| #1 Research | Winner |

| #1 Mobile Trading Apps | Winner |

| #1 Education | Winner |

| #1 Ease of Use | Winner |

| #1 Beginners | Winner |

| #1 Passive Investors | Winner |

| #1 Casual Investors | Winner |

| #1 Investor App | Winner |

| #1 Desktop Trading Platform | Winner |

| #1 Client Dashboard | Winner |

| #1 Overall Client Experience | Winner |

| #1 Stock Trading Platform | Winner |

| #1 Bond Trading Platform | Winner |

| 2025 | #1 |

| 2024 | #3 |

| 2023 | #5 |

| 2022 | #4 |

| 2021 | #3 |

| 2020 | #3 |

| 2019 | #3 |

| 2018 | #3 |

| 2017 | #3 |

| 2016 | #4 |

| 2015 | #6 |

| 2014 | #5 |

| 2013 | #3 |

| 2012 | #5 |

| 2011 | #3 |

Trade brilliantly with Schwab.

Why you can trust us

Table of Contents

Pros & ConsRange Of InvestmentsFeesMobile Trading AppsTrading PlatformsResearchEducationCustomer ServiceBanking ServicesFinal ThoughtsStar RatingsFAQs

Pros & cons

thumb_up_off_alt Pros

- Schwab’s thinkorswim is one of the most powerful trading platforms in the game.

- Extensive research with analyst reports and comprehensive fixed-income research.

- Top-tier education with webinars, videos, and courses.

thumb_down_off_alt Cons

- No direct crypto trading; ETFs are your only option.

- Stock Slices limited to companies in the S&P 500.

- The $5 fee for phone trades may frustrate some users.

My top takeaways for Charles Schwab in 2025:

- Thinkorswim integration: The addition of thinkorswim has elevated Schwab’s trading tools to a whole new level. Whether you’re charting economic data, analyzing earnings, or exploring advanced trading strategies, thinkorswim provides the depth and versatility active traders need to succeed.

- Comprehensive research and education: Schwab offers a variety of research “flavors,” from macro insights to detailed stock and fixed-income analysis. Its educational offerings, including immersive courses and live webinars, are polished, practical, and empowering, making it a standout for self-directed investors.

- Full-service experience: Schwab seamlessly combines investing and banking with thoughtful features like the Schwab Bank Investor Checking™ account and top-tier services for high-net-worth clients. Its personalized support and attention to detail ensure that all investors feel supported and valued.

Range of Investments

From my point of view, Charles Schwab is the ultimate full-service brokerage firm, and that’s not a term I use lightly. When I think “full service,” I expect a wide array of investment products and account types, all of which Schwab delivers.

From an investment product perspective, you’ll find stocks (including fractional shares via “Stock Slices”), ETFs, mutual funds, options, bonds, CDs, futures, and even access to forex through thinkorswim. The only noticeable gap is cryptocurrency trading, but for most investors, Schwab’s expansive range of offerings more than compensates for it.

currency_exchangeInterested in forex trading?

If you intend to trade forex, check out our comprehensive Charles Schwab forex review focusing primarily on this market at our sister site, ForexBrokers.com.

When it comes to account types, Schwab has too many to list. Individual accounts, traditional and Roth IRAs, rollover IRAs, spousal and beneficiary IRAs, 529 plans, custodial accounts, small business accounts, charitable accounts — you name it, they’ve got it. For even more details on its retirement services, head on over to our in-depth review of Charles Schwab’s IRA.

One of Schwab’s standout features, though not unique to them, is their commitment to personalized support. Local branches, specialized representatives for fixed income and active trading, and dedicated high-net-worth advisors ensure you’re never left figuring things out on your own. Having spent years on an active trader desk myself, I know firsthand how invaluable access to these experts can be for investors navigating the market.

I also found Schwab’s Investor Starter Kit intriguing. It’s Investing 101 with a clever twist. When you open and fund your account, Schwab gives you $101 to split equally across the top five stocks in the S&P 500, along with tools and education to guide your next steps. It’s a creative way to help new investors hit the ground running. Schwab also offers automated investing options and tax-efficient strategies, making it accessible to every type of investor.

| Feature |  |

|---|---|

| Stock Trading info | Yes |

| Account Feature – Margin Trading info | Yes |

| Fractional Shares (Stocks) info | Yes |

| OTC Stocks info | Yes |

| Options Trading info | Yes |

| Complex Options Max Legs info | 4 |

| Fixed Income (Treasurys) info | Yes |

| Futures Trading info | Yes |

| Forex Trading info | Yes |

| Crypto Trading info | No |

Continue Reading

account_balanceOne of the best for high net worth

We analyzed online brokers’ offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Charles Schwab fees

blob:https://www.stockbrokers.com/0200ffe5-1bd4-464d-80ea-8d899dc41896

At Schwab, listed stock and ETF trades are $0, and options trades are priced at $0.65 per contract, standard pricing that aligns with the rest of the industry. In my opinion, zero-dollar commissions on stocks and ETFs are the baseline these days. What really sets Schwab and other brokerages apart isn’t the price point but the tools and research they offer.

Penny stocks: Schwab charges $6.95 for OTC trades. If that’s what you gravitate toward, take a look at our penny stock trading guide, because some other brokers don’t tack on a fee.

Compare to Top Competitors

Overall5.0/5

Minimum Deposit$0.00

Stock Trades$0.00

Options (Per Contract)$0.65

SpotlightTrade brilliantly with Schwab.

Overall5.0/5

Minimum Deposit$0.00

Stock Trades$0.00

Options (Per Contract) info$0.65

SpotlightNew client offer, special margin rates.

Overall5.0/5

Minimum Deposit$0.00

Stock Trades$0.00

Options (Per Contract)$0.65

SpotlightGet up to $1K on new brokerage account*

Overall4.0/5

Minimum Deposit$0.00

Stock Trades$0.00

Options (Per Contract) info$0.00

SpotlightAccess margin rates as low as 5.5%

Fractional shares: Customers can purchase Schwab Stock Slices, which are fractional shares of any company in the S&P 500. The minimum purchase is $5. That should satisfy most investors, but some brokers offer fractional shares of ETFs, more stock choices, and permit investing as little as a dollar into a fractional share.

Mutual funds: Mutual fund fees are complicated at Schwab. Some transaction-fee mutual funds cost as high as $79.95 to buy. However, unlike most brokers, Schwab only charges for the original purchase. There is no charge for selling, and fees are waived for transactions under $100. For investors seeking no transaction fee (NTF), no load (NL) funds, Schwab offers 3,334 OneSource funds.

Other fees: If using the Schwab automated phone system to place a trade, a $5 fee will be added to the order. There is a $25 additional fee for broker-assisted trades.

| Feature |  |

|---|---|

| Minimum Deposit info | $0.00 |

| Stock Trades info | $0.00 |

| Penny Stock Fees (OTC) info | $6.95 |

| Options (Per Contract) info | $0.65 |

| Options Exercise Fee info | $0.00 |

| Options Assignment Fee info | $0.00 |

| Futures (Per Contract) info | $2.25 |

| Mutual Fund Trade Fee info | Varies |

| Broker Assisted Trade Fee info | $25 |

Mobile trading apps

In my view, Schwab’s mobile suite doesn’t just meet expectations — it exceeds them. While thinkorswim mobile may cater primarily to active traders, I’d argue it’s powerful enough to satisfy even the most demanding professionals. The flagship Schwab Mobile app, meanwhile, strikes a perfect balance for long-term and occasional investors, offering enough depth without overwhelming users.

Schwab Mobile: Everyday Investors

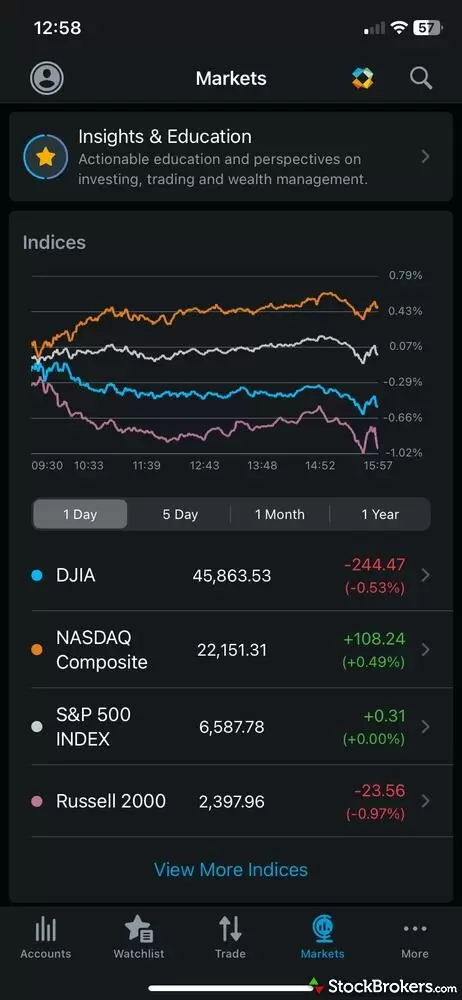

The flagship Schwab Mobile app is responsive, intuitive, and well-designed. It’s packed with data, live video feeds, and research to keep you informed. Upon opening the app for the first time, I was asked to choose my preferred start screen, and I immediately navigated to the market research page. This is smart integration. The market research within the app is a standout feature, with Schwab delivering a rich lineup that includes live videos from CNBC and the Schwab Network, daily market updates, and in-house commentary.

Schwab’s Market Research mobile homepage provides a quick snapshot of daily market performance, with real-time updates on major indices like the S&P 500, Dow, and Nasdaq. Users can also access breaking news headlines, macroeconomic insights, sector performance breakdowns, and even listen to an audio market update—all in one streamlined view.

Schwab’s leading education is fully integrated into the app. I could listen to one of the many podcast episodes, take a mobile-friendly course, and browse their Onward Magazine. When analyzing a stock, all the research I needed, including valuation metrics and in-depth research reports, was available directly in the app.

For those unsure of where to start, Schwab offers solutions to help you choose investments that go beyond simply highlighting market movers. You can even explore investment themes in greater depth, with themes presented as baskets of stocks with specific, predefined weightings — a nice and thoughtful integration.

thinkorswim Mobile: Active Traders

For active traders and technical analysis enthusiasts, the thinkorswim mobile app is a must have. With over 350 chart studies, real-time data, and customizable watchlists offering hundreds of column options, it’s a tool that can keep up with the most demanding trading styles. You can also take advantage of ladder trading, advanced order tickets, and pattern recognition for candlesticks and classic chart setups.

Schwab’s options trade ticket on mobile features a trade calculator view with both a P/L diagram and detailed table analysis. In this example, a 30-day-to-expiration at-the-money (ATM) cash-secured put on AAPL is displayed, clearly showing limited profit potential capped at the premium received—regardless of how high the stock rises. The payoff diagram also illustrates the increasing downside risk, mirroring the risk profile of stock ownership and highlighting the neutral to bullish bias of this strategy.

Options traders will appreciate the ability to build multi-leg spreads directly within the app, supported by 26 predefined strategies. While thinkorswim has fewer predefined strategies (17) than Schwab Mobile, it offers comprehensive customization with 31 columns for its options chain. The risk diagram, while tucked away at the bottom of the order ticket, provides sufficient functionality for assessing potential trades.

Schwab Assistant

The Schwab Assistant, an AI-powered tool within the Schwab Mobile app, adds a layer of convenience. You can use voice commands to check quotes, access market news, or even connect with a live representative. During my tests, it worked seamlessly, making basic tasks quicker and more intuitive.

| Feature |  |

|---|---|

| iPhone App info | Yes |

| Android App info | Yes |

| Apple Watch App info | Yes |

| Stock Alerts info | Yes |

| Charting – After-Hours info | Yes |

| Charting – Technical Studies info | 373 |

| Charting – Study Customizations info | Yes |

| Watchlist (Streaming) info | Yes |

| Mobile Watchlists – Create & Manage info | Yes |

| Mobile Watchlists – Column Customization info | Yes |

Trading platforms

Now that the merger with TD Ameritrade is complete, thinkorswim (TOS) has taken Schwab’s trading tools to an entirely new level. Now part of Schwab’s lineup, the platform delivers unmatched depth and versatility.

Thinkorswim’s introduction to the self-directed landscape was a monumental moment for advanced traders. The trading platform was sold in 2009 and has only gotten better. One of thinkorswim’s most underrated features — and a key differentiator from competitors — is its ability to chart economic data like unemployment rates, inflation metrics, and manufacturing trends. These fundamental forces drive the technicals, and being able to visualize them alongside charts of the broader markets offers traders a richer understanding of what’s moving price. For technical enthusiasts who sometimes focus too heavily on patterns and indicators, this feature brings balance to market analysis.

This screenshot showcases a desktop chart of U.S. unemployment rates alongside a live news feed and streaming headlines, enabling traders to track macroeconomic trends in real time. Access to this level of economic insight helps investors connect data with market movement.

Jessica’s take:

“A personal favorite of mine is Schwab’s earnings analysis tool. This tool overlays price action and volatility trends from past earnings reports with Wall Street analyst estimates and crowd-sourced ratings. For traders analyzing implied moves and historical performance, this tool is truly invaluable.”

That said, thinkorswim’s sheer depth and pure awesomeness can be overwhelming for new users. My advice? Skip the trial-and-error approach and dive straight into the tutorials as they’re comprehensive and worth every second. Once you get the hang of it, the payoff is nothing short of transformative.

Schwab continues to innovate with tools that cater to all types of investors. Key additions like paper trading for Schwab users help bridge the gap for those looking to refine their skills before committing real capital. Features like social sentiment charts, real-time stock scans, and workspace sharing highlight the depth and thoughtfulness behind Schwab’s trading experience.

| Feature |  |

|---|---|

| Active Trading Platform info | thinkorswim info |

| Desktop Trading Platform info | Yes |

| Desktop Platform (Mac) info | Yes |

| Web Trading Platform info | Yes |

| Paper Trading info | Yes |

| Trade Journal info | Yes |

| Watchlists – Total Fields info | 580 |

| Charting – Indicators / Studies info | 374 |

| Charting – Drawing Tools info | 24 |

| Charting – Study Customizations info | 35 |

Continue Reading

Research

When I assess the quality of research at a brokerage firm, I’m not just looking at the breadth of offerings. I’m asking: Is it useful? Is it written in plain language instead of foreign finance jargon? Can it translate into actionable decisions for the self-directed investor? Schwab’s research faced these tough questions and came out with a near-perfect score.

Macro Research (Broader Markets)

Let’s start with the macro. Schwab’s daily market update provides exactly the information I need to understand what’s moving the markets and where to focus my attention. It’s the first thing I want to read every morning. Schwab even offers an end-of-day podcast (yes, I subscribed) which provides a perfect mix of opinion, commentary, and education. Additionally, what sets the research apart is the “how to use this” methodology section, explaining how their insights can translate into actionable decisions.

The earnings calendar is another standout, offering a detailed view of prior year earnings, sorted by market cap and revenue. This layout made it easy for me to identify which companies and reports might have the biggest market-moving potential.

Idea Generation and Screeners

Next, I wanted to see how Schwab’s research helps investors turn macro insights into trade ideas. Schwab offers traditional stock screeners, predefined screens, and even screens for preferred securities.

Schwab’s web-based stock screener stands out with advanced filtering tools that include forward-year P/E ratios, projected EPS growth, and revenue estimates—ideal for forward-looking investors. The platform allows users to screen for S&P 500 stocks based on future performance metrics, earnings surprises, and Schwab Analyst Ratings. Unlike many screeners that focus solely on historical data, Schwab helps investors identify high-potential opportunities based on forward projections.

The stock screener was phenomenal. I could filter for S&P 500 stocks based on forward-year P/E ratios, EPS growth, and revenue growth. It also does so not just for historical data, but for future projections too (which means it’s actually useful). While it’s full of acronyms, Schwab integrates dynamic explanations as you build the screen, making it a learning experience, too. This blend of functionality and contextual education is top-notch.

The fixed income screener was equally impressive and one of my favorite among brokers I’ve tested. It visualized the trade-offs between risk, duration, and yield in a way that was easy to understand. I could build a ladder with CDs or Treasurys and even view a yield curve complete with insights on the economic factors impacting it. Schwab also smartly included bond funds as a call-to-action for those who might prefer funds over individual fixed-income products.

Micro Research (Individual Securities)

Beyond baseline data, I had access to detailed analyst reports, consolidated analyst opinions, forward P/E ratios, short interest, dividend details, and an array of valuation metrics. Schwab also provides side-by-side comparisons with the company’s competitors, which is more than most brokers offer.

Funds and fixed-income products were given the same meticulous treatment. My favorite small feature? Schwab creates tabs for the securities and funds you’re analyzing, making it easy to switch between them without losing track of your research.

Fixed Income Analysis

Analyzing fixed income at Schwab is a dream. When searching for a bond, I was first presented with insights from Schwab’s experts on the state of the market, including macro trends like the Yen’s influence, historical bond prices, and yield curve peaks before Fed rate cuts. This level of depth helps bridge the gap between market events and individual investment decisions.

Schwab’s tools provide ratings, watchlist alerts from agencies, and contextual education for corporate bonds, bond funds, CDs, munis, and Treasurys. It’s clear, actionable, and incredibly helpful for any investor navigating the fixed-income space.

| Feature |  |

|---|---|

| Research – Stocks info | Yes |

| Stock Research – ESG info | Yes |

| Stock Research – PDF Reports info | 7 |

| Screener – Stocks info | Yes |

| Research – ETFs info | Yes |

| Screener – ETFs info | Yes |

| Research – Mutual Funds info | Yes |

| Screener – Mutual Funds info | Yes |

| Research – Pink Sheets / OTCBB info | Yes |

| Research – Fixed Income info | Yes |

Education

The standout feature for me was Schwab’s educational courses. I typically open a course, skim through it, and move on. Not this time. I found myself fully engaged for four hours straight while exploring the Leading Economic Indicators course. It was that good. Schwab offers eight courses, each spanning 3 to 5 hours, with progress tracking, a table of contents, and assessment quizzes at the end.

Schwab’s value investing course offers a deep dive into the fundamentals of analyzing stocks, making it ideal for long-term, self-directed investors. This introductory screen explores the basics of fundamental analysis—like P/E ratios, earnings reports, and intrinsic value—to help investors identify undervalued opportunities.

For those who prefer live learning, Schwab is one of the few brokerages that offers a wide array of live and on-demand webinars. These sessions are frequent, interactive, and feature live Q&A, providing incredible value for investors looking to learn in real time. Schwab’s commitment to offering constant and accessible webinars nicely complements its broader educational offerings.

While Schwab’s content covering stocks, funds, and options is excellent, the organization could use some work. Important note: this is a theme with most brokerage firms. However, Schwab’s bond section is a notable exception. It’s structured in a way that makes learning about bonds intuitive and logical. The content flows from understanding who issues bonds and types of bonds to the role of the Federal Reserve and how market mechanics influence them.

Schwab’s macro education is polished, visually engaging, and incredibly useful. I stumbled across a video explaining how economic indicators work, and it was a masterclass in simplicity and clarity. The video used graphics and real-time market examples to break down complex topics, leaving self-directed investors with a clear understanding of how to apply what they learned.

Despite the occasional lack of organization, Schwab excels at strategically placing contextual education throughout the user experience. This integration, whether on research pages or within tools, matters more than having perfectly ordered categories. It ensures that when you need guidance or an explanation, it’s right there, woven seamlessly into the process.

| Feature |  |

|---|---|

| Education (Stocks) info | Yes |

| Education (ETFs) info | Yes |

| Education (Options) info | Yes |

| Education (Mutual Funds) info | Yes |

| Education (Fixed Income) info | Yes |

| Education (Retirement) info | Yes |

| Paper Trading info | Yes |

| Videos info | Yes |

| Webinars info | Yes |

| Progress Tracking info | Yes |

Continue Reading

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year’s testing, 130 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details in several areas of broker services for prospective customers, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for Charles Schwab.

- Average Connection Time: 1 minute

- Average Net Promoter Score: 9.1 / 10

- Average Professionalism Score: 9.0 / 10

- Overall Score: 9.08 / 10

- Ranking: 2nd of 13 brokers

Banking services

Charles Schwab’s banking solutions are thoughtfully designed for the modern investor. The Schwab Bank Investor Checking™ account offers unlimited ATM fee rebates worldwide and no foreign transaction fees—perfect for those who love to travel. It’s seamlessly linked to a Schwab One® brokerage account, making it easy to manage your finances in one place. Best of all, there are no monthly service fees or minimum balance requirements. Additionally, Schwab’s banking services have over 400 service locations and is a registered member of the Federal Deposit Insurance Corporation (FDIC), which insures bank deposits up to $250,000.

| Feature |  |

|---|---|

| Bank (Member FDIC) info | Yes |

| Checking Accounts info | Yes |

| Savings Accounts info | Yes |

| Credit Cards info | Yes |

| Debit Cards info | Yes |

| Mortgage Loans info | Yes |

Final thoughts

Charles Schwab has set a new standard for what it means to be a full-service brokerage firm. From its seamless integration of thinkorswim for advanced trading to its best-in-class research and education, Schwab caters to investors of all levels with a thoughtful, well-rounded approach. Whether you’re diving into macroeconomic trends, exploring individual securities, or utilizing Schwab’s intuitive mobile and desktop platforms, the tools and resources are designed to empower self-directed investors to make confident, informed decisions.

Schwab’s ability to balance innovation with simplicity is what truly sets it apart. While there’s room for improvement, like expanding fractional shares and cryptocurrency offerings, it’s hard to deny the immense value Schwab provides. With its top-notch educational content, robust research tools, and a commitment to serving both beginner and high-net-worth clients, Schwab proves that it’s more than just a brokerage — all too well.

Charles Schwab Star Ratings

| Feature |  |

|---|---|

| Overall | |

| Range of Investments | |

| Mobile Trading Apps | |

| Platforms & Tools | |

| Research | |

| Customer Service | |

| Education | |

| Ease of Use |

FAQs

Did Charles Schwab buy TD Ameritrade?

Yes, Schwab entered into an agreement to buy TD Ameritrade for approximately $26 billion of Schwab stock in November 2019. The deal closed in October 2020. Schwab clients now gain access to TDA’s excellent thinkorswim platforms as well as vastly upgraded trading abilities and educational content.

Is Charles Schwab good for beginners?

Charles Schwab is rated as our best trading platform for beginners. New investors will benefit from Schwab’s excellent research, education, and support. There’s even live coaching for traders via Schwab Coaching on YouTube.

Does thinkorswim have a Mac version?

Yes, I personally tested thinkorswim on both my MacBook Pro and MacBook Air, and it runs smoothly. There’s also a dedicated thinkorswim mobile app for iPhones and iPads, making it a great platform for Apple aficionados. thinkorswim also nabbed our award for the #1 Desktop Trading Platform for 2025 thanks to its powerful tools and features — an experience that extends seamlessly to Mac users.

Mac Users:

- Requires OS X 10.11 or later (Check by clicking the Apple menu > “About This Mac”).

- Download and install the thinkorswim .dmg file from the official site.

Apple iPhone (iOS) Users:

- thinkorswim mobile is available for iPhone, iPad, and iPod Touch.

- Download it from the App Store by searching “thinkorswim” and tapping “Get.”

- Once installed, the thinkorswim icon will appear on your device.

Does thinkorswim have a trading journal?

No, thinkorswim does not have a built-in trading journal beyond basic tools like trade history and performance reports. However, you are able to export trading data to third-party journals for more comprehensive analysis. If you’re looking for the best trading journal options, check out our guide to the best trading journals for 2025.

Does Schwab have hidden fees?

Schwab does not have hidden fees. Schwab’s pricing page is filled with footnotes that explains every intricacy of the fees charged for clarity. The broker also makes money from payment for order flow, or PFOF, which is normal for the industry with only a few notable exceptions like Fidelity.

Is Charles Schwab safe?

Founded in 1971, Charles Schwab has a great history of reliability in the investment industry. It’s regulated by the Securities and Exchange Commission (SEC), the Financial Industry Regulation Authority (FINRA), and, for its banking services, the FDIC.

Can you buy fractional shares on Charles Schwab?

Yes, Schwab’s fractional shares, called “Stock Slices,” allow smaller investors to diversify their risks across different companies and industries. With over 500 stocks available, Stock Slices provide more than enough choices for individual stock investors. That said, some brokers allow fractional share purchases of exchange-traded funds, which can offer even more diversification.

How much money do you need to open a Charles Schwab account?

Schwab does not have a minimum deposit requirement to open an account. It also offers Stock Slices, which allow you to buy fractions of shares with as little as $5; and it offers mutual funds with minimum investments of $100.